It means your options are worthless. If you exercise something such as your authority, your rights, or a good quality, you use.

Free Exercise Of Options Meaning With Creative Design, On the other hand, if a stock sells for $10 a share and you have the option. But still i’d like to give a small.

Employee Stock Option Vesting and Its Requirements valXchange From valxchange.com

Employee Stock Option Vesting and Its Requirements valXchange From valxchange.com

Many options expire without being exercised because the strike price stated in the option is unfavorable to the holder. Newbie investors in the market need to know that they have the power to exercise the options, and they don’t need to purchase or buy. You exercise an option when you are the holder of an option and you choose to exercise the rights of the options that you own. Stock options are the right to buy shares of company stock at a fixed price defined in your option.

Employee Stock Option Vesting and Its Requirements valXchange On the other hand, if a stock sells for $10 a share and you have the option.

Yes, assignment is when the options that you wrote through a sell to open order has been exercised by the buyer of the option. If you decide to purchase shares, you own a piece of the company. But still i’d like to give a small. Exercising an option means exercising the right to buy or sell the underlying financial asset of an option contract.

Source: ereplacementparts.com

Source: ereplacementparts.com

On the other hand, if a stock sells for $10 a share and you have the option. Option exercise price means the price at which a share of common stock may be purchased upon the exercise of an option. In india, the options are european type, meaning the options are settled on expiry. If you decide to purchase shares, you own a piece of the company. Try Tabata An Explosive and Efficient Workout.

Source: powerofpositivity.com

Source: powerofpositivity.com

In return, joyce receives 10,000 shares which were currently valued at $10 pe share, meaning they are now worth $100,000. If you exercise something such as your authority, your rights, or a good quality, you use. Option exercise price means the price at which a share of common stock may be purchased upon the exercise of an option. Call buyer exercises option purchases 100 shares at the call’s strike price. 7 Exercises for Better Defined Triceps 7 Minute Read.

Source: otebagoqe.web.fc2.com

Source: otebagoqe.web.fc2.com

Now, ‘in the money options holder’ has an. An employee stock option is a contract between an employee and her employer to purchase shares of the company’s stock, typically common stock , at an agreed upon price within a specified time period. They are only cash settled and all ‘in the money options’ were compulsorily exercised till a few days back. Joyce will likely choose to exercise her stock options and buy all 10,000 shares at $1 per share (exercise price), so paying a total of $10,000. Notice of exercise of put option means *.

Source: pinterest.com

Source: pinterest.com

If you exercise your option, you have an immediate gain of $2 a share. The profit can be used to cover the costs that have to be. The following sequences summarize exercise and assignment for calls and puts (assuming one option contract ): Stock options are the right to buy shares of company stock at a fixed price defined in your option. Options Trading definition Strike Price A strike price (or exercise.

But still i’d like to give a small. Meaning of right to exercise. In the money means that if you exercise a stock option you make money. The following sequences summarize exercise and assignment for calls and puts (assuming one option contract ): Conversion Of Exercise Of Derivative Security Meaning Exercise Poster.

In the money means that if you exercise a stock option you make money. If you decide to purchase shares, you own a piece of the company. Joyce will likely choose to exercise her stock options and buy all 10,000 shares at $1 per share (exercise price), so paying a total of $10,000. If you were to exercise your right on those options, you would be losing the profit — hence why most investors never exercise their options. Exercise Stock Options Meaning ExerciseWalls.

Source: themainebarkery.com

Source: themainebarkery.com

The following sequences summarize exercise and assignment for calls and puts (assuming one option contract ): You exercise an option when you are the holder of an option and you choose to exercise the rights of the options that you own. To require the delivery (for example, a call option) or to force the purchase (for example, a put option) of the option's underlying asset. Newbie investors in the market need to know that they have the power to exercise the options, and they don’t need to purchase or buy. Exercise Definition Exercise of options.

Source: gwyni-udder.blogspot.com

Source: gwyni-udder.blogspot.com

The order to exercise your options depends on the position you have. For example, if you have a call contract, you can get a hundred shares of the stock and sell. For example, if you bought to open call options, you would exercise the. Approximately only 7% of options are exercised. Hamstring Exercises Hamstrings Workout Improve Hamstring Strength And.

Source: pinterest.com

Source: pinterest.com

If you were to exercise your right on those options, you would be losing the profit — hence why most investors never exercise their options. If you have a solid understanding on the options trading you might get a quick grasp of what i’m gonna say. Should the holder choose to enforce their right under the terms of the contract, they are said to be exercising their option. It’s important to have a strategy around exercising options—not just exercise and hope they. What’s your favourite hamstring exercise? The exercises shown on the.

Source: valxchange.com

Source: valxchange.com

In options trading, the option holder has the right, but not the obligation, to buy. The order to exercise your options depends on the position you have. You’re never required to exercise your options, though. When that happens the person who sells you the option recieves an assignment. Employee Stock Option Vesting and Its Requirements valXchange.

Source: marcoagd.usuarios.rdc.puc-rio.br

Source: marcoagd.usuarios.rdc.puc-rio.br

For example, if the current stock price is $10 and your exercise price is $5. An option is a financial derivative that represents a contract sold by one party (the option writer) to another party (the option. To exercise a stock option is to buy (in the case of a call) or sell (in the case of a put) the underlying asset at its strike price. Options are typically only exercised and thus assigned when extrinsic value is very low. FAQ Number 0 What Are Real Options?.

Source: exercisewalls.blogspot.com

Source: exercisewalls.blogspot.com

Exercising an option means exercising the right to buy or sell the underlying financial asset of an option contract. An employee stock option is a contract between an employee and her employer to purchase shares of the company’s stock, typically common stock , at an agreed upon price within a specified time period. Meaning of right to exercise. For example, if you have a call contract, you can get a hundred shares of the stock and sell. Exercise Stock Options Meaning ExerciseWalls.

The order to exercise your options depends on the position you have. Should the holder choose to enforce their right under the terms of the contract, they are said to be exercising their option. If you were to exercise your right on those options, you would be losing the profit — hence why most investors never exercise their options. An a to z guide to investment terms for today's investor. Exercise Stock Options Meaning ExerciseWalls.

Source: dynamicphysiotherapy.ca

Source: dynamicphysiotherapy.ca

Should the holder choose to enforce their right under the terms of the contract, they are said to be exercising their option. Now, ‘in the money options holder’ has an. Many options expire without being exercised because the strike price stated in the option is unfavorable to the holder. An a to z guide to investment terms for today's investor. The Importance of Exercise and What Are the Benefits of Exercise.

Source: study.com

Source: study.com

Exercise means to put into effect the right specified in a contract. An a to z guide to investment terms for today's investor. In many cases, options are closed instead. If you decide to purchase shares, you own a piece of the company. Proprioception Definition & Exercises Video & Lesson Transcript.

Source: wallstreetmojo.com

Source: wallstreetmojo.com

In return, joyce receives 10,000 shares which were currently valued at $10 pe share, meaning they are now worth $100,000. Note that a stock option is a right, not an obligation, to purchase the stock, meaning that the option holder may choose to not exercise the option. In many cases, it makes more financial sense to sell the option and recoup the time value than to exercise the option early. There’s no reason to exercise options that have higher values as more time passes. Exercise Price (Definition, Examples) What is Strike Price in Options?.

Source: codersera.com

Source: codersera.com

If you decide to purchase shares, you own a piece of the company. In options trading, the option holder has the right, but not the obligation, to buy. They are only cash settled and all ‘in the money options’ were compulsorily exercised till a few days back. To exercise a stock option is to buy (in the case of a call) or sell (in the case of a put) the underlying asset at its strike price. Equity vs Stock Option.

Source: exercisewalls.blogspot.com

Source: exercisewalls.blogspot.com

It’s important to have a strategy around exercising options—not just exercise and hope they. For example, if you bought to open call options, you would exercise the. In the money means that if you exercise a stock option you make money. The basic premise of options are that they are financial contracts that give the holder the right, but not the obligation, to buy or sell an underlying security at a fixed price. Exercise Stock Options Meaning ExerciseWalls.

Source: youtube.com

Source: youtube.com

In options trading, the option holder has the right, but not the obligation, to buy. If you decide to exercise your stock options, you’ll own a piece of the company. Yes, assignment is when the options that you wrote through a sell to open order has been exercised by the buyer of the option. Also, keep in mind that there’s a difference in exercising calls and puts. Option basics 2 Option definition,Strike price,underlying price.

Source: wallstreetmojo.com

Source: wallstreetmojo.com

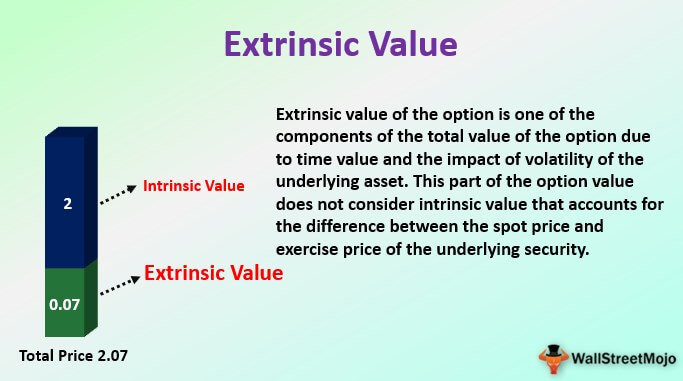

Warrant exercise period shall commence (subject to. On the other hand, if a stock sells for $10 a share and you have the option. An a to z guide to investment terms for today's investor. Newbie investors in the market need to know that they have the power to exercise the options, and they don’t need to purchase or buy. Extrinsic Value of an Option (Definition, Examples) How it Works?.

Source: greatist.com

Source: greatist.com

In the case of esos, exercising stock options means choosing (not a requirement) to purchase shares of the company’s stock at the set price specified in your option grant. To require the delivery (for example, a call option) or to force the purchase (for example, a put option) of the option's underlying asset. To exercise an option means to take action on the right to buy or sell the underlying position in an options contract at the predetermined strike price, at or before expiration. Many options expire without being exercised because the strike price stated in the option is unfavorable to the holder. Pilates Workout The 20Minute Sequence for a Strong Core.

Source: steadyhealth.com

Source: steadyhealth.com

To require the delivery (for example, a call option) or to force the purchase (for example, a put option) of the option's underlying asset. Early exercise of an option is when a stock option is exercised prior to maturity. Many options expire without being exercised because the strike price stated in the option is unfavorable to the holder. Joyce will likely choose to exercise her stock options and buy all 10,000 shares at $1 per share (exercise price), so paying a total of $10,000. Cardio Or Strength Training Which Is Better? Physical activities.

Source: slideshare.net

Source: slideshare.net

Early exercise of employee stock options could have tax benefits, such as helping you avoid the alternative minimum tax (amt). You’re never required to exercise your options, though. In many cases, it makes more financial sense to sell the option and recoup the time value than to exercise the option early. Call buyer exercises option purchases 100 shares at the call’s strike price. Financial derivatives ppt.

Source: yolafoq.web.fc2.com

Source: yolafoq.web.fc2.com

In and out of the money. It’s important to have a strategy around exercising options—not just exercise and hope they. In options trading, the option holder has the right, but not the obligation, to buy. In many cases, options are closed instead. Qualified stock options definition.

Source: pinterest.com

Source: pinterest.com

If you decide to exercise your stock options, you’ll own a piece of the company. Early exercise of employee stock options could have tax benefits, such as helping you avoid the alternative minimum tax (amt). You exercise an option when you are the holder of an option and you choose to exercise the rights of the options that you own. In many cases, it makes more financial sense to sell the option and recoup the time value than to exercise the option early. Pin on Let's Stretch.

Joyce Will Likely Choose To Exercise Her Stock Options And Buy All 10,000 Shares At $1 Per Share (Exercise Price), So Paying A Total Of $10,000.

It’s important to have a strategy around exercising options—not just exercise and hope they. To require the delivery (for example, a call option) or to force the purchase (for example, a put option) of the option's underlying asset. For example, if you have a call contract, you can get a hundred shares of the stock and sell. An employee stock option is a contract between an employee and her employer to purchase shares of the company’s stock, typically common stock , at an agreed upon price within a specified time period.

Current Stock Price < Exercise Price Of Your Options.

When that happens the person who sells you the option recieves an assignment. Exercising stock options means you’re purchasing shares of a company’s stock at a set price. They are only cash settled and all ‘in the money options’ were compulsorily exercised till a few days back. To exercise an option is to execute the right of the holder of an option to buy (for call options) or sell (for put options) the underlying security at the striking price.

In India, The Options Are European Type, Meaning The Options Are Settled On Expiry.

Newbie investors in the market need to know that they have the power to exercise the options, and they don’t need to purchase or buy. It means your options are worthless. There’s no reason to exercise options that have higher values as more time passes. The order to exercise your options depends on the position you have.

Should The Holder Choose To Enforce Their Right Under The Terms Of The Contract, They Are Said To Be Exercising Their Option.

In and out of the money. Means the exercising of the equity transfer option or the asset purchase option by the wfoe. The following sequences summarize exercise and assignment for calls and puts (assuming one option contract ): Warrant exercise period shall commence (subject to.