Detailed guidance, regulations and rules. Income tax on particular items imported into indonesia is at least 2.5%, but it may be greater in other cases.

List Of Indonesia Customs Regulations With Creative Ideas, There will be several documents that must be submitted to the relevant technical bodies involved too. The documents must be available when required to obtain your final.

Indonesia Intangible Goods Are Now Subject To Import Duty From conventuslaw.com

Indonesia Intangible Goods Are Now Subject To Import Duty From conventuslaw.com

Detailed guidance, regulations and rules. The export regulations in indonesia also states that all exported items must have a pemberitahuan ekspor barang (peb). Pos indonesia wishes to inform other union member countries and their designated operators of the changes to national customs regulations effective 1 august 2021. According to pmk 199/2019 issued by the ministry of finance, the maximum.

Indonesia Intangible Goods Are Now Subject To Import Duty Indonesia’s customs is implementing a new update by 1st august 2021.

An import license holder must declare all goods imported into indonesia to the indonesian directorate general of customs and excise. Link is provided below and you can complete before landing. With its network of 108 offices across the united states and in more than 75 countries, the u.s. The actual value is determined by the hs code of the goods being imported into indonesia.

Source: blog.boxme.asia

Source: blog.boxme.asia

There are four types of import licenses available in indonesia: This is the list of application that we provide for services. Indonesia can be a difficult place to clear customs. Please note that a returning indonesian Indonesia tightens import regulations on foreign goods.

Source: textilevaluechain.in

Source: textilevaluechain.in

Department of commerce utilizes its global presence and international marketing. This is the list of application that we provide for services. Dear delyvanow customers, with immediate effects, starting on 1st august 2021, indonesia’s customs is updating its regulations to make it mandatory to obtain and include the local tax id (npwp) of consignees based in indonesia for each consignment note. Public 2021 indonesia customs regulatory changes overview •customs authorities across the world are increasingly mandating additional data elements for customs clearance purposes. Indonesia to tighten textile import rules. TEXTILE VALUE CHAIN.

Source: blog.boxme.asia

Source: blog.boxme.asia

The export regulations in indonesia also states that all exported items must have a pemberitahuan ekspor barang (peb). There are four types of import licenses available in indonesia: The embassy of the republic of indonesia 2020 massachusetts ave nw washington, dc 20036 u.s.a. Link is provided below and you can complete before landing. Indonesia tightens import regulations on foreign goods.

Source: lekslawyer.com

Source: lekslawyer.com

Customer must be in country for clearance. Detailed guidance, regulations and rules. Fairness, in a sense that customs formalities shall only be the obligation of any person being involved in customs activity and such a person shall be treated equally under the same terms and condition; Department of commerce utilizes its global presence and international marketing. Jakarta Law Firm Minister Trade of the Republic Indonesia Regulation.

Source: blog.boxme.asia

Source: blog.boxme.asia

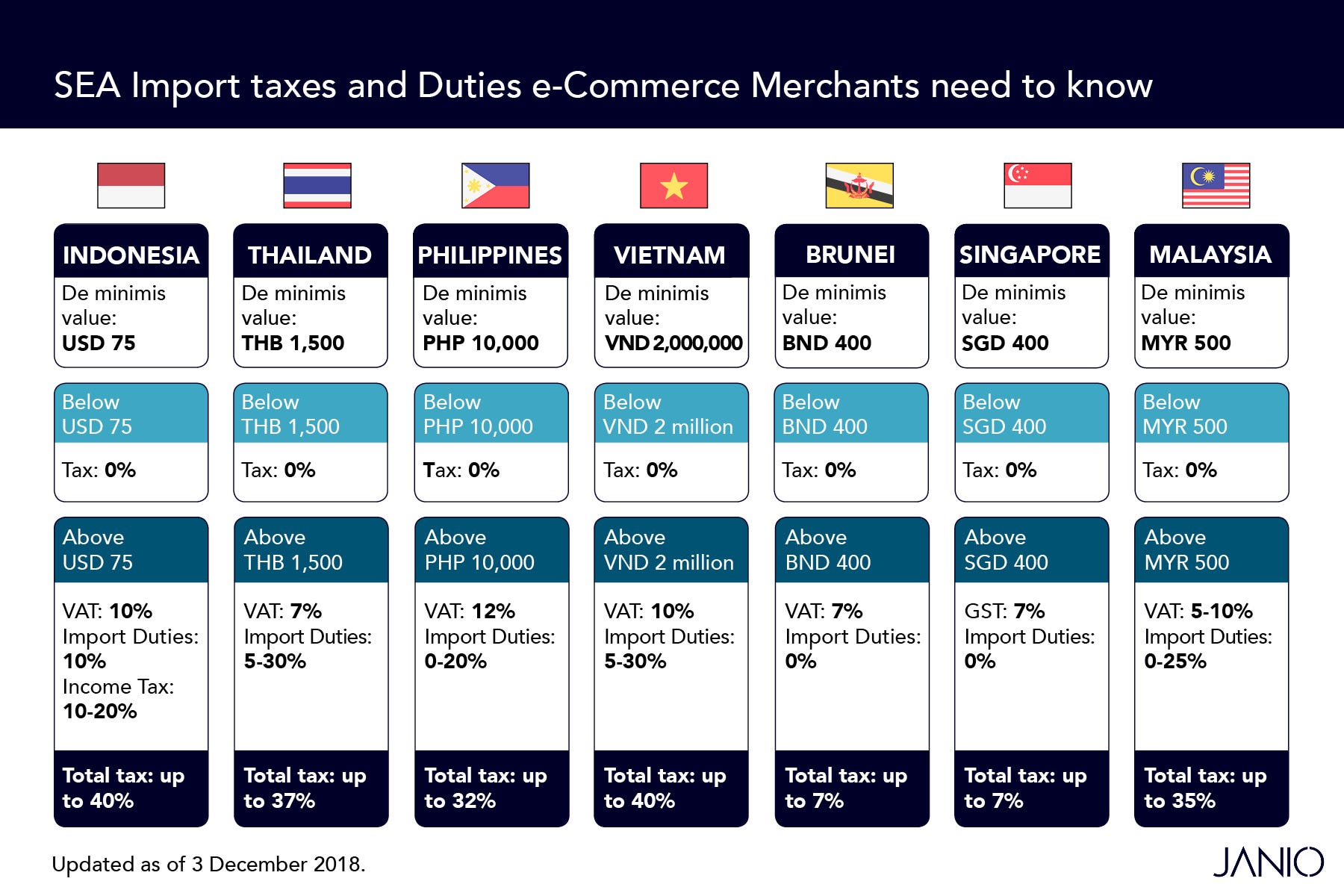

In addition, you also need to check your country’s regulations for goods you are sourcing from indonesia. Based on mot regulation 70/2015, all importers must obtain an import license. A new governmental regulation stipulates the import duties in indonesia has been effective since january 30, 2020. Fairness, in a sense that customs formalities shall only be the obligation of any person being involved in customs activity and such a person shall be treated equally under the same terms and condition; Understand import taxes & regulations in Malaysia Boxme Global.

Source: bd.apparelresources.com

Source: bd.apparelresources.com

1 | all international travelers, both indonesian citizens and foreign. Indonesia can be a difficult place to clear customs. In addition, you also need to check your country’s regulations for goods you are sourcing from indonesia. Customs and excise application systems. Why India’s new customs rules and Indonesia’s move to impose safeguard.

Source: emerhub.com

Source: emerhub.com

Nonetheless, if you already have a supplier for goods from indonesia, then the steps are as follows. 1 | all international travelers, both indonesian citizens and foreign. Firms continue to report that indonesian customs relies on a schedule of reference prices to assess duties on some imports, rather than using actual transactions as required by the wto agreement on customs valuation. Department of commerce utilizes its global presence and international marketing. How to Calculate Custom Duty and Import Tax in Indonesia Emerhub.

Source: lfsgroup.org

Source: lfsgroup.org

Pos indonesia wishes to inform other union member countries and their designated operators of the changes to national customs regulations effective 1 august 2021. Tourist visa have to pay duties for photo and film cameras unless this equipment is registered in their passport by the indonesian customs on former occasion. The first step is to complete all the required documents in indonesia. Procedures require up to 20 sequential stamps, authorizations and signatures. News LFS GLOBAL LOGISTICS Indonesia Relaxes Import Regulations.

Source: rouse.com

Source: rouse.com

Detailed guidance, regulations and rules. Firms continue to report that indonesian customs relies on a schedule of reference prices to assess duties on some imports, rather than using actual transactions as required by the wto agreement on customs valuation. Customs and excise application systems. Every personal passenger goods, per person on every arrival, is granted import duties, excise, and taxes exemption of usd 500.00 on their personal goods (personal effect) that were purchased or obtained abroad and will remain in indonesia. Rouse Indonesia Customs Implementing Regulations for IP recordal.

Source: abyasiasepakat.com

Source: abyasiasepakat.com

Firms continue to report that indonesian customs relies on a schedule of reference prices to assess duties on some imports, rather than using actual transactions as required by the wto agreement on customs valuation. Normal custom clearance takes from 5 to 7 working days, provided that all documents are in order. Nonetheless, if you already have a supplier for goods from indonesia, then the steps are as follows. Public 2021 indonesia customs regulatory changes overview •customs authorities across the world are increasingly mandating additional data elements for customs clearance purposes. Customs Brokerages Agent PT ABY ASIA SEPAKAT.

Source: aseanbriefing.com

Source: aseanbriefing.com

This must be submitted to the customs and excise office. The documents must be available when required to obtain your final. Commercial service of the u.s. Nonetheless, if you already have a supplier for goods from indonesia, then the steps are as follows. Import and Export Procedures in Malaysia Best Practices ASEAN.

Source: conventuslaw.com

Source: conventuslaw.com

For any inbound service and rate inquiry, please contact us. Normal custom clearance takes from 5 to 7 working days, provided that all documents are in order. This customs law has considered the following aspects: Income tax on particular items imported into indonesia is at least 2.5%, but it may be greater in other cases. Indonesia Intangible Goods Are Now Subject To Import Duty.

Source: 3ecpa.co.id

Source: 3ecpa.co.id

Nonetheless, if you already have a supplier for goods from indonesia, then the steps are as follows. Indonesia customs regulations and procedures for importing and exporting goods at indonesian border. This must be submitted to the customs and excise office. Commercial service of the u.s. Import and Export Regulation and Process in Indonesia a Guideline.

Call us 7 days a week. •in order to ensure a smooth customs clearance, it’s essential that shippers provide complete & accurate data electronically to dhl express. Customer must be in country for clearance. Incentives provision which will bring benefit for the national economic OOCL Electronic IB Cargo Manifest.

Source: medium.com

Source: medium.com

An import license holder must declare all goods imported into indonesia to the indonesian directorate general of customs and excise. Indonesia can be a difficult place to clear customs. Indonesia customs regulations and procedures for importing and exporting goods at indonesian border. Includes customs regulations and contact information for this country's customs office. Customs Clearance in Southeast Asia Guide for B2C Business.

Source: balistoreluggage.com

Source: balistoreluggage.com

A new governmental regulation stipulates the import duties in indonesia has been effective since january 30, 2020. Public 2021 indonesia customs regulatory changes overview •customs authorities across the world are increasingly mandating additional data elements for customs clearance purposes. This is the list of application that we provide for services. Reports, analysis and official statistics. Indonesia custom declaration form front Bali in a nutshell.

Source: kargo.tech

Source: kargo.tech

Import duties might range anywhere from 0% to 450%. The documents must be available when required to obtain your final. Customs and excise application systems. Commercial service of the u.s. Import and Export Regulations in Indonesia (Prohibited and Restricted.

Source: blog.boxme.asia

Source: blog.boxme.asia

The first step is to complete all the required documents in indonesia. In indonesia, the value added tax (vat) is set at 10%. Import duties might range anywhere from 0% to 450%. Commercial service of the u.s. Indonesia tightens import regulations on foreign goods.

Source: countryaah.com

Source: countryaah.com

With its network of 108 offices across the united states and in more than 75 countries, the u.s. Identification requirements for b2c indonesia imports. Incentives provision which will bring benefit for the national economic Indonesia can be a difficult place to clear customs. Indonesia Import Restrictions.

Source: intheair.aersure.com

Source: intheair.aersure.com

There are four types of import licenses available in indonesia: Firms continue to report that indonesian customs relies on a schedule of reference prices to assess duties on some imports, rather than using actual transactions as required by the wto agreement on customs valuation. Dear delyvanow customers, with immediate effects, starting on 1st august 2021, indonesia’s customs is updating its regulations to make it mandatory to obtain and include the local tax id (npwp) of consignees based in indonesia for each consignment note. With its network of 108 offices across the united states and in more than 75 countries, the u.s. Indonesia changed their import regulation! And you need to know about it..

Source: 3ecpa.co.id

Source: 3ecpa.co.id

With its network of 108 offices across the united states and in more than 75 countries, the u.s. Detailed guidance, regulations and rules. Tourist visa have to pay duties for photo and film cameras unless this equipment is registered in their passport by the indonesian customs on former occasion. The actual value is determined by the hs code of the goods being imported into indonesia. Import and Export Regulation and Process in Indonesia a Guideline.

Source: emerhub.com

Source: emerhub.com

Indonesia’s customs is implementing a new update by 1st august 2021. Procedures require up to 20 sequential stamps, authorizations and signatures. 29 of 2021 (gr 29/2021), an implementing regulation of omnibus law. Indonesia customs regulations and procedures for importing and exporting goods at indonesian border. Setting Up an Import Company In Indonesia.

Source: lekslawyer.com

Source: lekslawyer.com

In addition, you also need to check your country’s regulations for goods you are sourcing from indonesia. According to pmk 199/2019 issued by the ministry of finance, the maximum. Customer must be in country for clearance. This customs law has considered the following aspects: Jakarta Law Firm Minister Trade of the Republic Indonesia Regulation.

Source: waste360.com

Source: waste360.com

There will be several documents that must be submitted to the relevant technical bodies involved too. For any inbound service and rate inquiry, please contact us. The documents must be available when required to obtain your final. This customs law has considered the following aspects: Indonesia Finalizes Scrap Import Regulations Waste360.

Source: mirandahlaw.com

Source: mirandahlaw.com

According to pmk 199/2019 issued by the ministry of finance, the maximum. Arrival of the shipment in indonesia must be within 3 (three) months upon client’s arrival in indonesia to reside. Income tax on particular items imported into indonesia is at least 2.5%, but it may be greater in other cases. Fairness, in a sense that customs formalities shall only be the obligation of any person being involved in customs activity and such a person shall be treated equally under the same terms and condition; New Indonesia Customs Regulation for Protection of IP Rights.

Identification Requirements For B2C Indonesia Imports.

For any inbound service and rate inquiry, please contact us. Pos indonesia wishes to inform other union member countries and their designated operators of the changes to national customs regulations effective 1 august 2021. The latest regulation update for import to indonesia. This must be submitted to the customs and excise office.

In Addition, You Also Need To Check Your Country’s Regulations For Goods You Are Sourcing From Indonesia.

29 of 2021 (gr 29/2021), an implementing regulation of omnibus law. The embassy of the republic of indonesia 2020 massachusetts ave nw washington, dc 20036 u.s.a. Includes customs regulations and contact information for this country's customs office. Reports, analysis and official statistics.

Import Duties Might Range Anywhere From 0% To 450%.

Procedures require up to 20 sequential stamps, authorizations and signatures. Commercial service of the u.s. The documents must be available when required to obtain your final. 1 | all international travelers, both indonesian citizens and foreign.

Nonetheless, If You Already Have A Supplier For Goods From Indonesia, Then The Steps Are As Follows.

Indonesia can be a difficult place to clear customs. Department of commerce utilizes its global presence and international marketing. With its network of 108 offices across the united states and in more than 75 countries, the u.s. Firms continue to report that indonesian customs relies on a schedule of reference prices to assess duties on some imports, rather than using actual transactions as required by the wto agreement on customs valuation.